Platform Of Titan Series General Azevedotechcrunch

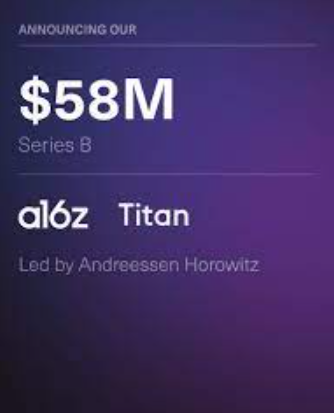

Titan series general azevedotechcrunch, a platform with the goal of appealing to the “average investor,” has been valued at $450 million as a16z leads with $58 million in Series B funding. The Series B round of funding was led by Andreessen Horowitz (a16z).The funding comes just a little over five months after Titan secured $12.5 million in a Series A round that was led by General Catalyst, and it takes the total amount raised by the business since its 2017 launch to $75 million. It places a value of 450 million on the corporation.

Along with BoxGroup, Ashton Kutcher’s Sound Ventures, and a number of prominent sportsmen and celebrities, including Odell Beckham Jr., Kevin Durant, Jared Leto, and Will Smith, General Catalyst contributed funding to the Series B round of funding.

In February of 2018, the firm introduced its first investment strategy, and as of now, it has a customer base of 30,000 people. The company refers to itself as “a new-guard active investment manager.” According to the firm, Titan’s platform increased by 500% in the previous 12 months, mostly organically. The Titan plans to cross $1 billion in assets under management by the end of this year. Titan stated that the company was approaching $500 million in assets under management and had positive cash flow for the previous year when it completed its most recent round of funding in February. More details are…

The titan series general azevedotechcrunch is to younger generations what Fidelity and its legendary mutual funds were to baby boomers. According to Percoco, “Titan is the first direct-to-consumer (DTC), mobile-first investing platform where regular investors, regardless of wealth, may have their cash actively managed by investment specialists in long-term strategies.” [Citation needed]

Mutual fund titan series general azevedotechcrunch

He continued by saying that a mutual fund or an ETF is “really simply a piece of technology allowing an investment manager to collect money from someone in order to invest in securities.” He made this statement in reference to both of the previously mentioned financial products. And compared that piece of technology to an old-fashioned VHS tape, saying that while it “does the job,” it is “archaic for a few reasons.” According to him, the grounds for this include the fact that the investor is an “anonymized monetary value” and that the items have several layers of expenses, large minimums, and are difficult to produce.

The plant that actually produces the mutual funds is rather ancient. According to Percoco, “the whole investment management profession is built on these VHS tapes.” [Citation needed] “These are the antiquated technologies that are now being used. We are completely reconstructing it at this point. The Fidelity building was once a factory. Titan is essentially a whole new manufacturing facility.

The titan series general azevedotechcrunch is planning to debut its cryptocurrency offering on August 3. At the time of its introduction, Titan Crypto will be accessible to all residents of the United States. With the exception of individuals whose primary residence is in the state of New York. Once Titan’s custodial partner has obtained regulatory clearance for the state’s jurisdiction, it will be possible for citizens of New York to get access to the platform.

Titan has said that it plans to set up a way for other investment managers to sell. Their products from its “factory” in the near future.

According to Percoco

According to Percoco, the initial methods available on Titan’s platform focus primarily on stock investments. We are already getting questions from people who manage billions of dollars and want to launch their products on titan series general azevedotechcrunch.

As well as making new hires, the firm intends to put its newly acquired funding into further developing. Its underlying technology and expanding its portfolio of financial products. It has around 30 employees at the moment, which is an increase from seven a year ago. Titan is projected to have one hundred staff members by this time next year, according to Percoco.

Anish Acharya, a general partner at A16z, said that his company has been “consistently happy” with Titan’s product vision, execution. And team since meeting them the year before.

Acharya, who will be joining Titan’s board as part of the financing. Stated that if we pull back and look at trends happening in consumer investing. We can see that younger generations are embracing more risk in investing. That they demand easy-to-navigate, mobile-first interfaces and transparency from their banks. And participate in the learning from that process.” “If we pull back and look at trends happening in consumer investing, we can see that younger generations

In his opinion, titan series general azevedotechcrunch, in his opinion, occupies a position at an “interesting intersection” between passive robo-advisors and active stock-pricing. This positioning “allows their customers to ride shotgun alongside some of the best fund managers in the world. “He says, “thus achieving the returns and knowledge of stock picking without having to make the decisions themselves.”